In these times of uncertain returns, fixed deposits have become the most preferred banking instruments for planning a financially worry-free future for the family. Which is why Mahindra Finance’s Fixed Deposit scheme has been specially designed to assure you of guaranteed returns at highly competitive interest rates with this low-risk investment.

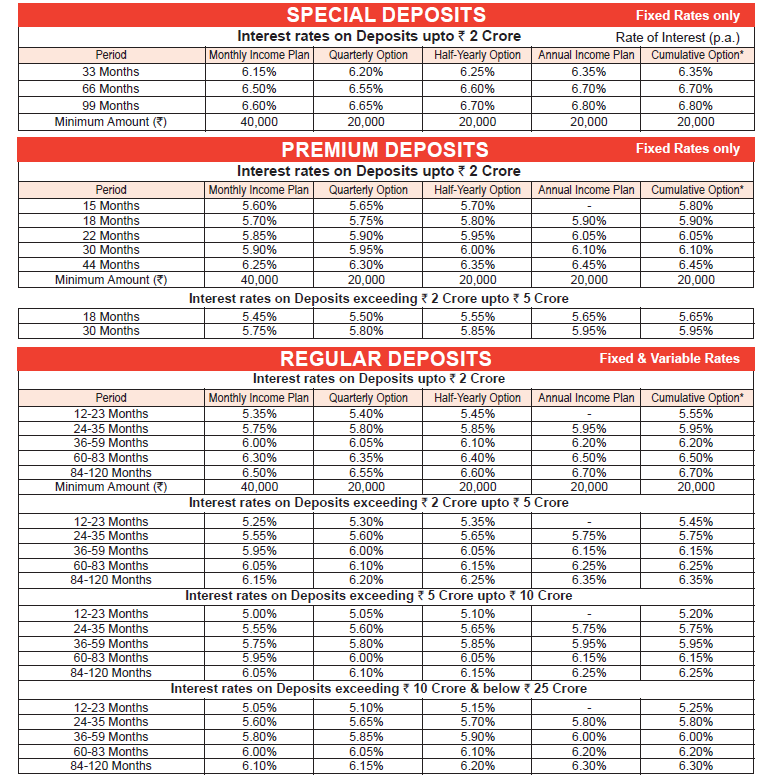

Fixed Deposit rates w.e.f 20th September 2021.

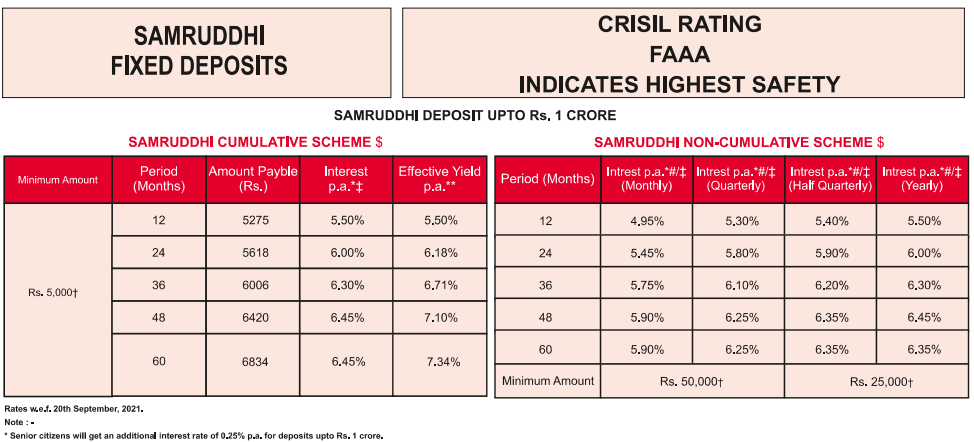

- The MMFSL Fixed Deposit has a CRISIL rating of 'FAAA', which indicates a high level of safety

- 0.25% additional interest rate for senior citizens for Samruddhi Fixed Deposits

The above mentioned ratings indicate highest degree of safety with regard to timely payment of interest and principal on the instrument.

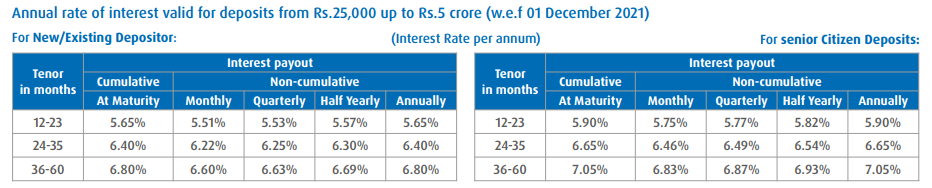

Make your money work for you with ICICI HFC Fixed Deposits. Start small with as less as ₹ 10,000 and enjoy high interest rates that grow your savings! ICICI HFC offers you flexible tenure options of anywhere between 12 to 120 months and allows convenient withdrawals so you always have access to your money. Watch your wealth grow safely and you rest assured with the highest credit ratings in the industry:

- Highest Degree of Safety: FAAA/Stable by CRISIL

- Highest Degree of Safety: MAAA/Stable by ICRA

- Highest Degree of Safety: AAA/Stable by CARE

Unlike some other investment tools, Fixed Deposits are not market-driven. If you invest in a fixed deposit, you would get an assured return at the end of the maturity period.

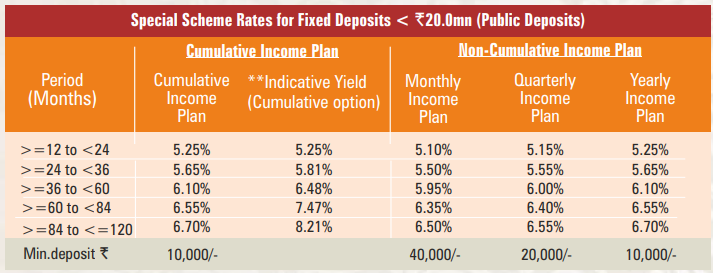

Fixed Deposit is a fixed income product that assures steady returns. LIC Housing Finance Ltd has launched SANCHAY deposit scheme in May 2007.

Since its launch SANCHAY deposit scheme by LIC Housing Finance Ltd is rated FAAA/Stable by CRISIL. This is the highest rating provided to deposit instrument for any deposit taking entity.

Public Deposit will be accepted from Resident Individuals, Non-Resident Individuals, Minors through guardians, HUFs, Partnership Firms, Co-operative Societies, Association of Persons, Proprietary Concern, Trusts and others as decided by management.

- FAAA/STABLE rating by CRISIL

- Attractive Card Rates

- Monthly and Yearly Interest Payment Option under Non- Cumulative Scheme

- Interest Compounded Annually under Cumulative Scheme

- Auto Renewal/ Auto Repayment Facility available

- Electronic Payment Facility for Interest payment and Principal Payment

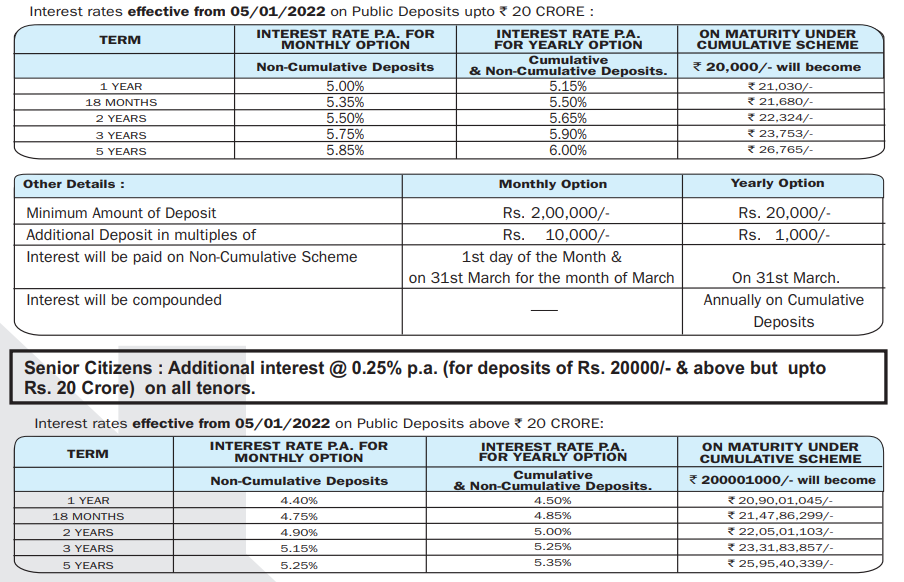

- Additional benefit of 0.25% p.a. in interest rate to senior citizens (for deposits upto Rs. 20 Crore on all tenures)

- Quick sanction of Loan against Deposit up to 75% of Deposit Amount

Monthly Interest payment and Annual Interest payment options available under Non- Cumulative Deposit Scheme. Tenure available for 1 Year, 18 Months, 2 Year, 3 Year and 5 Year under Non-Cumulative Public Deposit Scheme. Attractive card rates for deposit amount upto Rs 20 Crore and above Rs.20 Crore for all tenure.

- Annually on 31st March under Annual Option.

- On 1st day of the month and on 31st March for the month of March under Monthly Option.

- Annual Option for Non-Cumulative Deposit Scheme:

- Minimum Amount: Rs. 20,000/- and thereafter in multiples of Rs. 1,000/-

- Monthly Option for Non- Cumulative Deposit Scheme:

- Minimum amount: Rs. 2,00,000/- and thereafter in multiples of Rs. 10,000/-

Safeguarding our environment from climate change is the need of the hour. To play our part in combating climate change, HDFC has introduced, Green & Sustainable Deposits, a product that supports United Nations' Sustainable Development Goals (SDGs). Green and Sustainable Deposits will help enhance HDFC's participation in projects directly supporting United Nations' SDGs and empower our depositors to opt for financial products that have a positive impact on the environment, and the society at large.