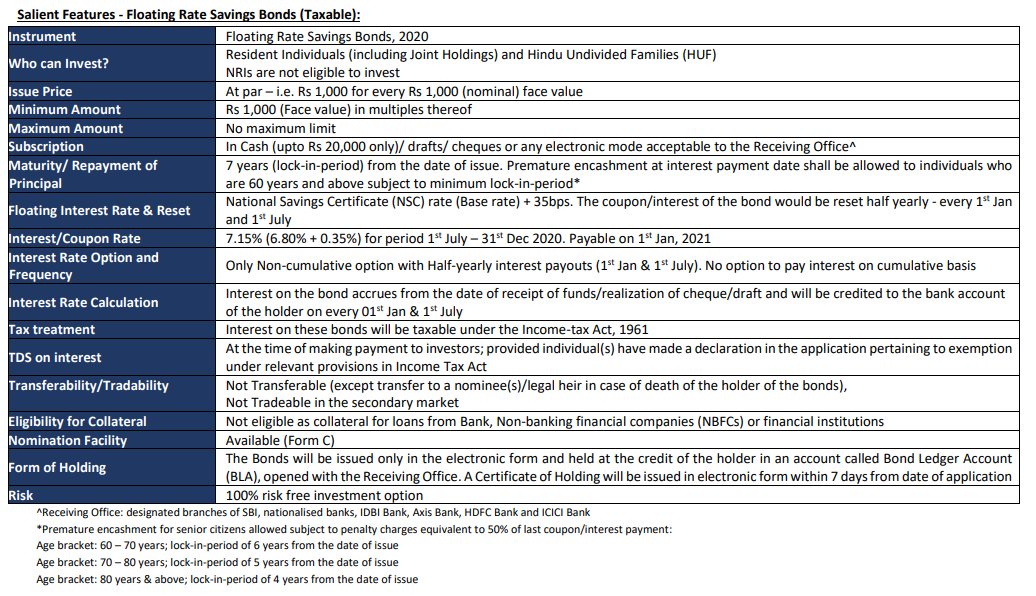

The Government of India launched the Floating Rate Savings Bonds, 2020 (Taxable) scheme on July 01, 2020 to enable Resident Indians/HUF to invest in a taxable bond, without any monetary ceiling

- Minimum investment of Rs.1,000

- No maximum limit on investment

- Floating rate of interest with a Half Yearly interest payout

- 100% risk free investment option

- 7 years tenure of the bond from the date of issue with a special provision for premature redemption for Senior Citizens.

- An Individual, not being a Non-Resident Indian

- A Hindu Undivided Family

Comparison between 7.75% (Fixed) Savings Bonds vs Floating Rate Savings Bond: Interest/coupon payouts linked to a base rate makes periodic payments variable; changing according to the market situations. As compared to a fixed rate plain vanilla bond which are tradeable, floating rate debt instruments helps to lower the interest rate risk as interest rates are aligned to market rate and resets at regular intervals. Since these bonds have a lock-in period and are held to maturity, there is no question of interest rate risk during the tenor. Investors could gain or lose out compared to a fixed pay bond; but it keeps payouts to aligned to market interest rates. NSC rates are expected to broadly move in-line to inflation rates. A drawback of Floating rate savings bonds is that it does not offer stability and predictability of cashflows like a fixed pay bond.

Comparison with other similar Debt Instruments: Floating Rate Savings Bond are completely safe with virtually zero credit risk. The existing rate offered is competitive to Bank FD rates (even senior citizen FD) and post office deposit rates; relatively longer lock-in than FD makes it less appealing. In comparison with other government-backed schemes like Senior Citizen Savings Schemes (SCSS), Pradhan Mantri Vaya Vandana Yojana (PMVVY), Public Provident fund (PPF); these floating rate bonds offer mildly lower interest rate and does not have tax benefits (sec 80C); but these instruments have an upper limit on investment amount. Also, PPF serves a different purpose of wealth accumulation over the years; and not for earning regular income like these bonds. On comparing with Taxfree bonds (listed) issued by public sector enterprises; investors falling in lower slab rates would be better off investing in these floating rates savings bond - on post tax basis. Despite having a little higher credit and interest rate risk, taxfree bond offers better liquidity. Who Can Invest? Investing in these bonds is an attractive proposition for individuals especially in the lower income tax bracket from the point of view of locking in interest rates and ensuring safety of principal. Senior Citizens who have surplus money beyond their emergency needs and looking for higher interest rates can invest in these bonds. Investors looking for a safe investment avenue while earning a steady income can opt for this scheme after having provided for their liquidity needs (after exhausting 80C limits). These bonds offer guaranteed interest and complete capital protection.